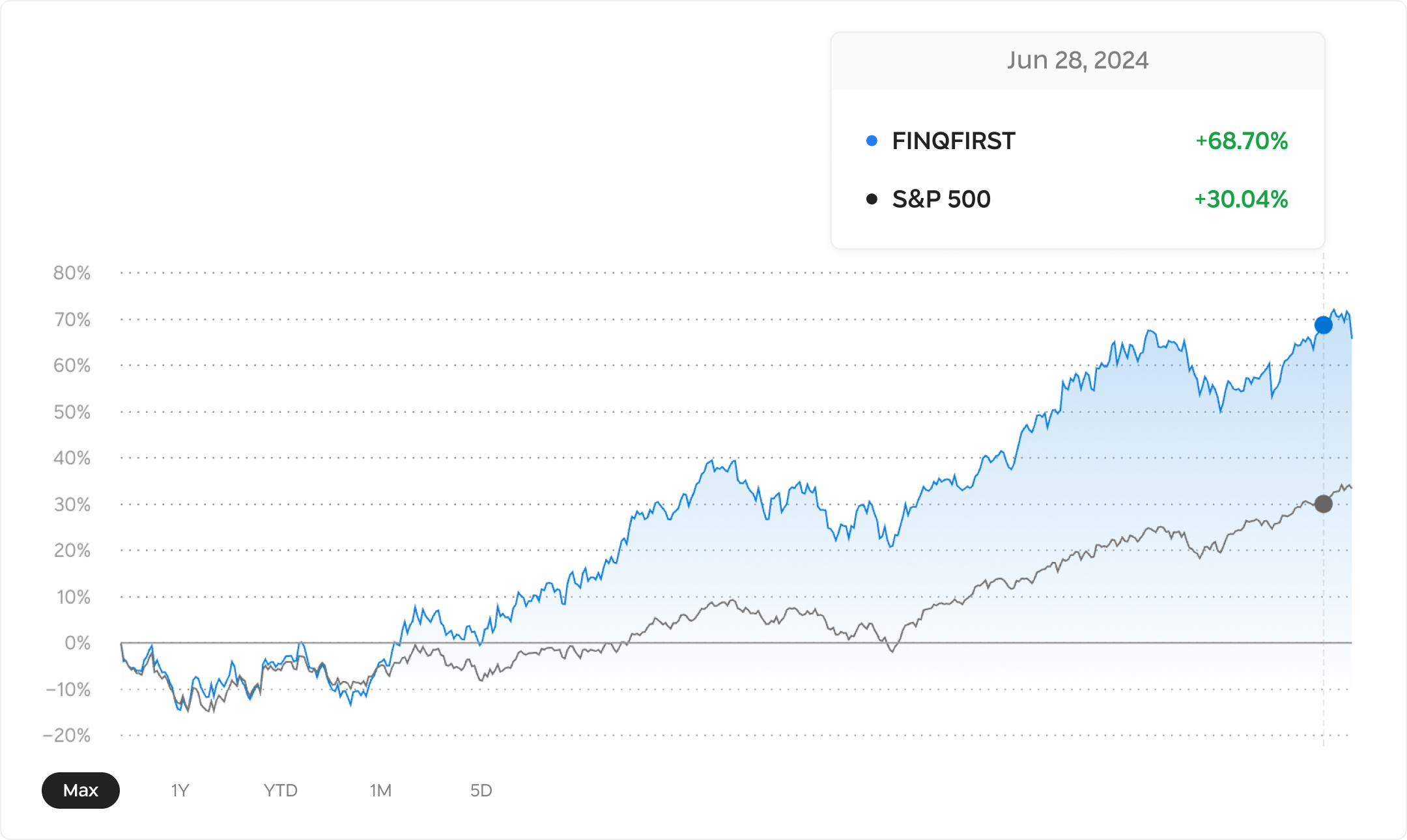

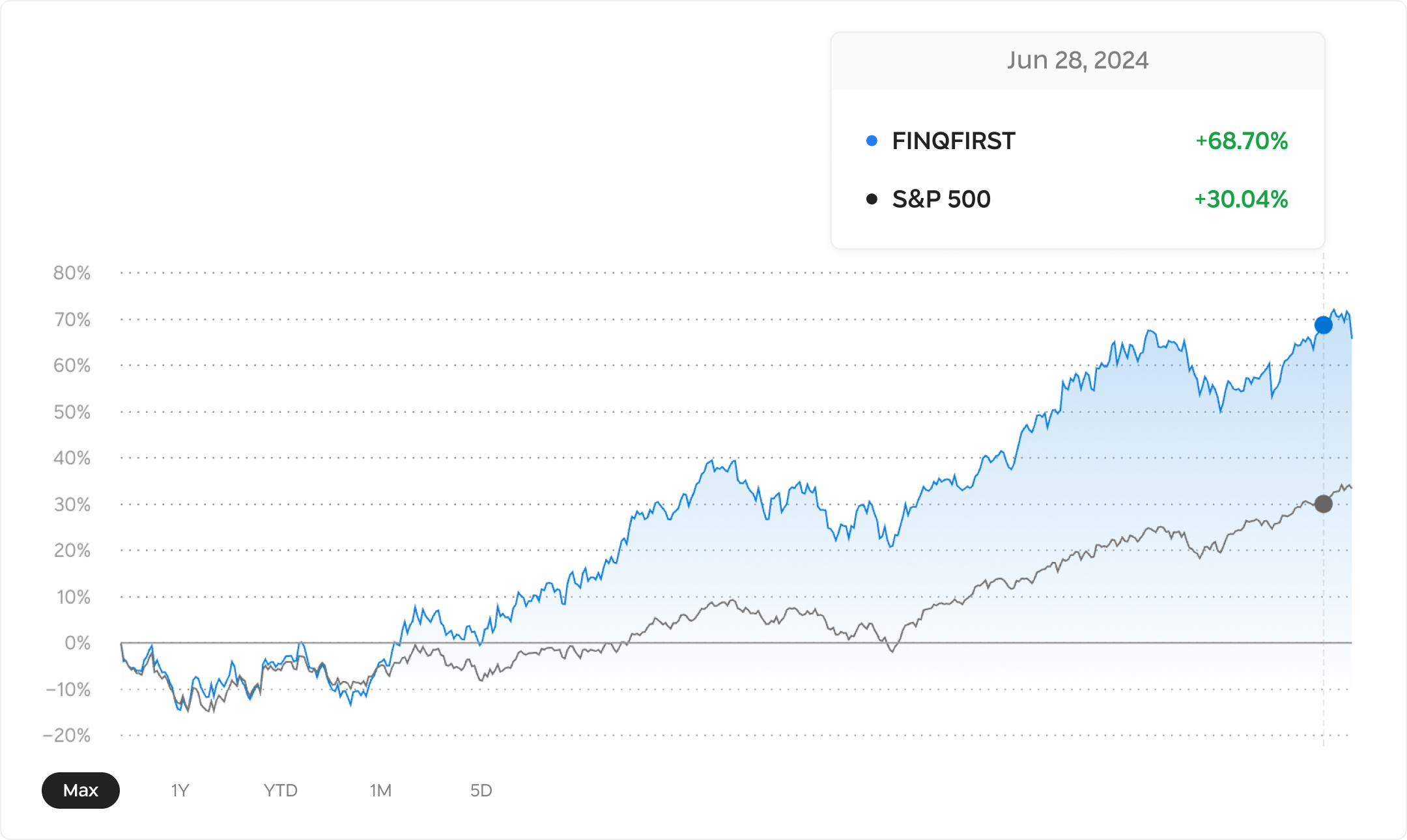

Comparative performance: FINQFIRST vs S&P500

Have you ever wondered how some investment portfolios beat the market consistently? Let’s talk about FINQFIRST’s track record against the S&P 500, and you'll see what we mean:

- Long-term growth: Since its start on August 24, 2022, FINQFIRST has soared to a 68.70% gain, while the S&P 500 has climbed 30.04%. That’s more than double the growth in less than two years!

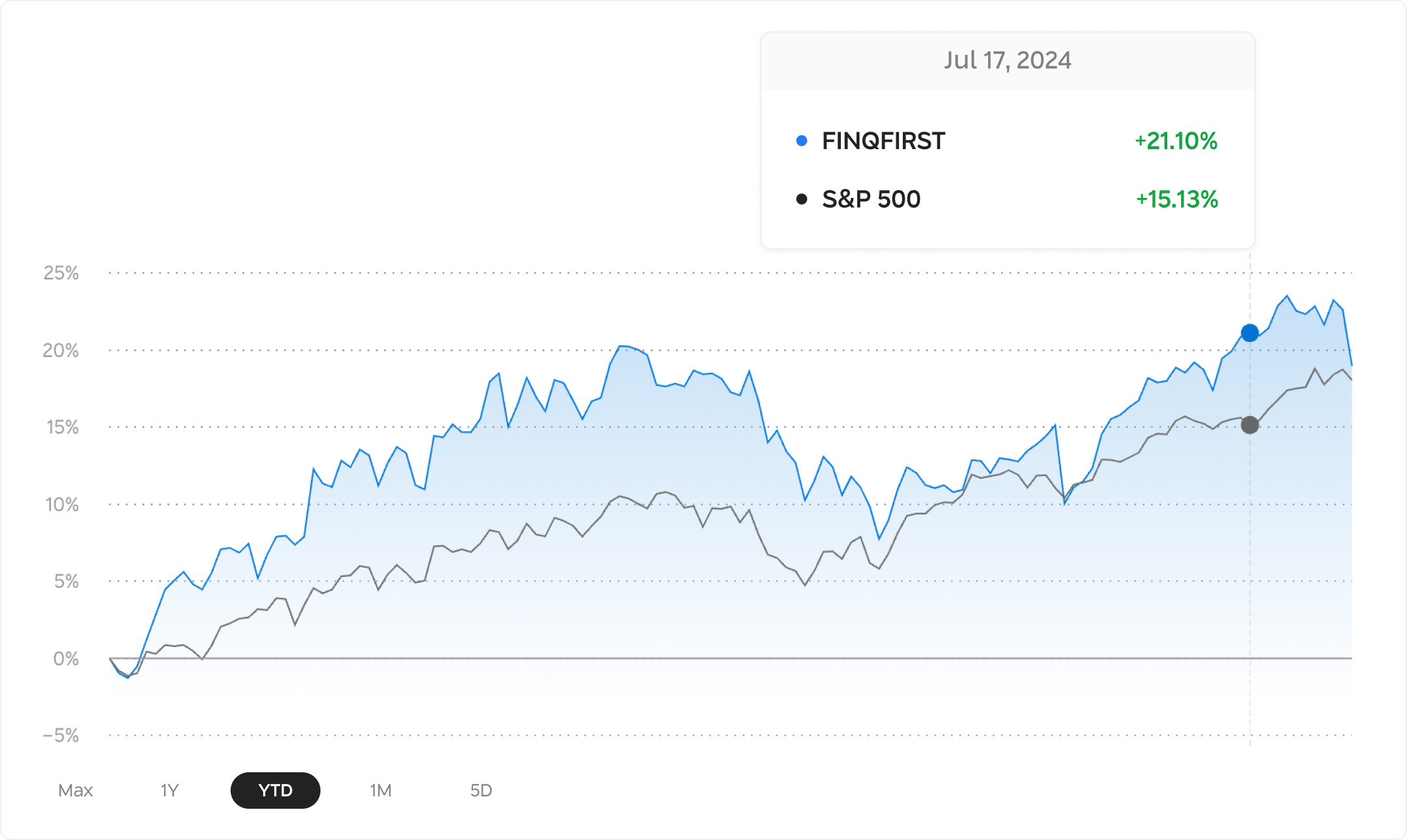

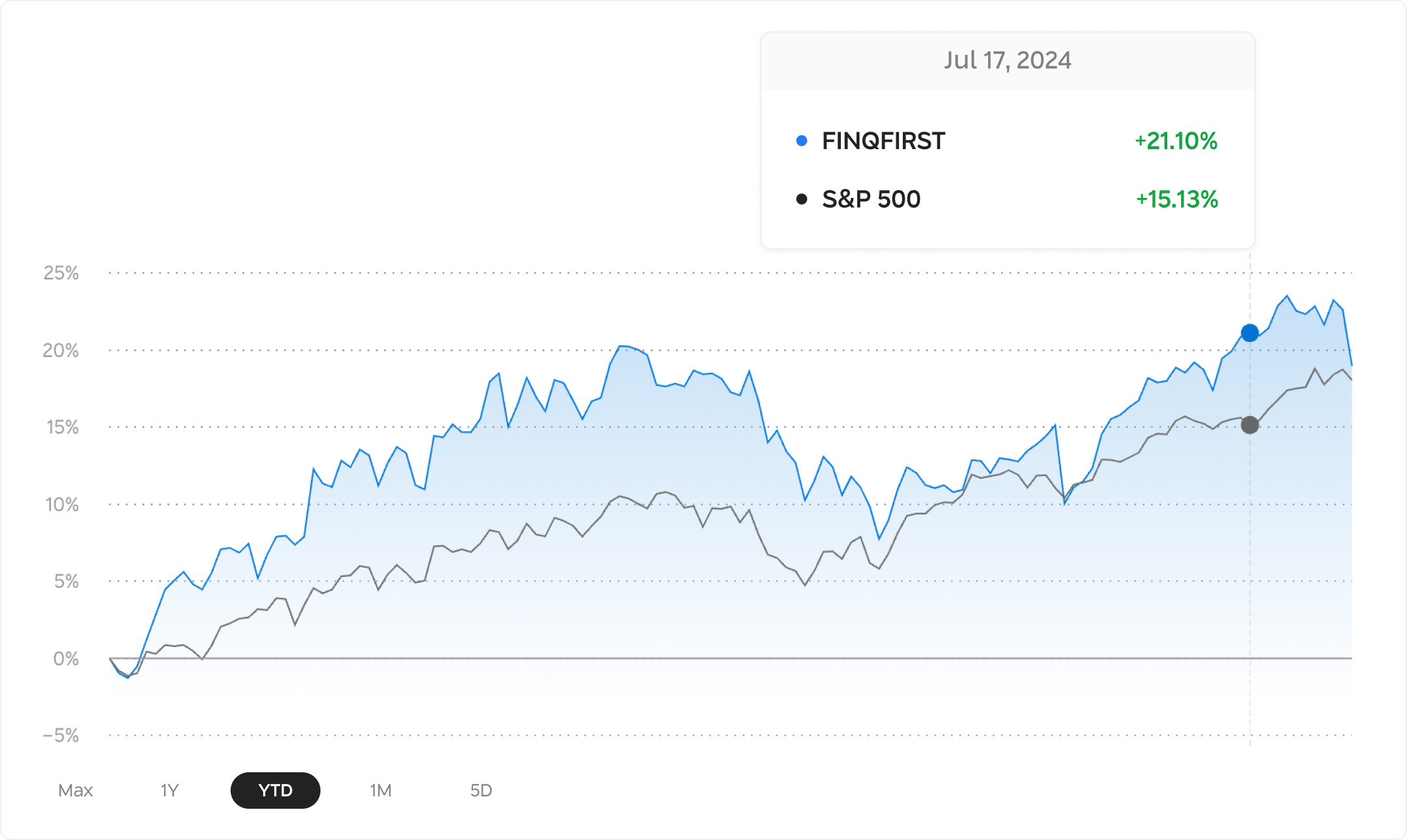

- Staying ahead this year: As of June 28, 2024, FINQFIRST is up 21.10% for the year, surpassing the S&P 500’s 15.13%. It’s not just about picking stocks; it’s about picking winners.

- Recent performance: FINQFIRST returned 5.97% in the last month, outperforming the S&P 500’s rise of 3.20%.

Top-ranked stocks analysis by FINQ

So, with all that said, what are the top stocks behind the scenes regarding FINQFIRST’s outperformance? What did the AI uncover this quarter? Let’s dig into the top 5.

1. Amazon.com Inc. (AMZN)

Amazon is on a roll, with its financials and market share looking better than ever. In the first quarter alone, net sales surged to $143.3 billion—a 13% increase. They've more than tripled their operating income, and their cash flow is booming. Holding a commanding 37.6% of the U.S. e-commerce market, Amazon rings up about $1.6 billion in sales each day, largely thanks to a vibrant community of third-party sellers. Things do not appear to be slowing down anytime soon, with growth projected to continue and plans to expand its Brand Registry,

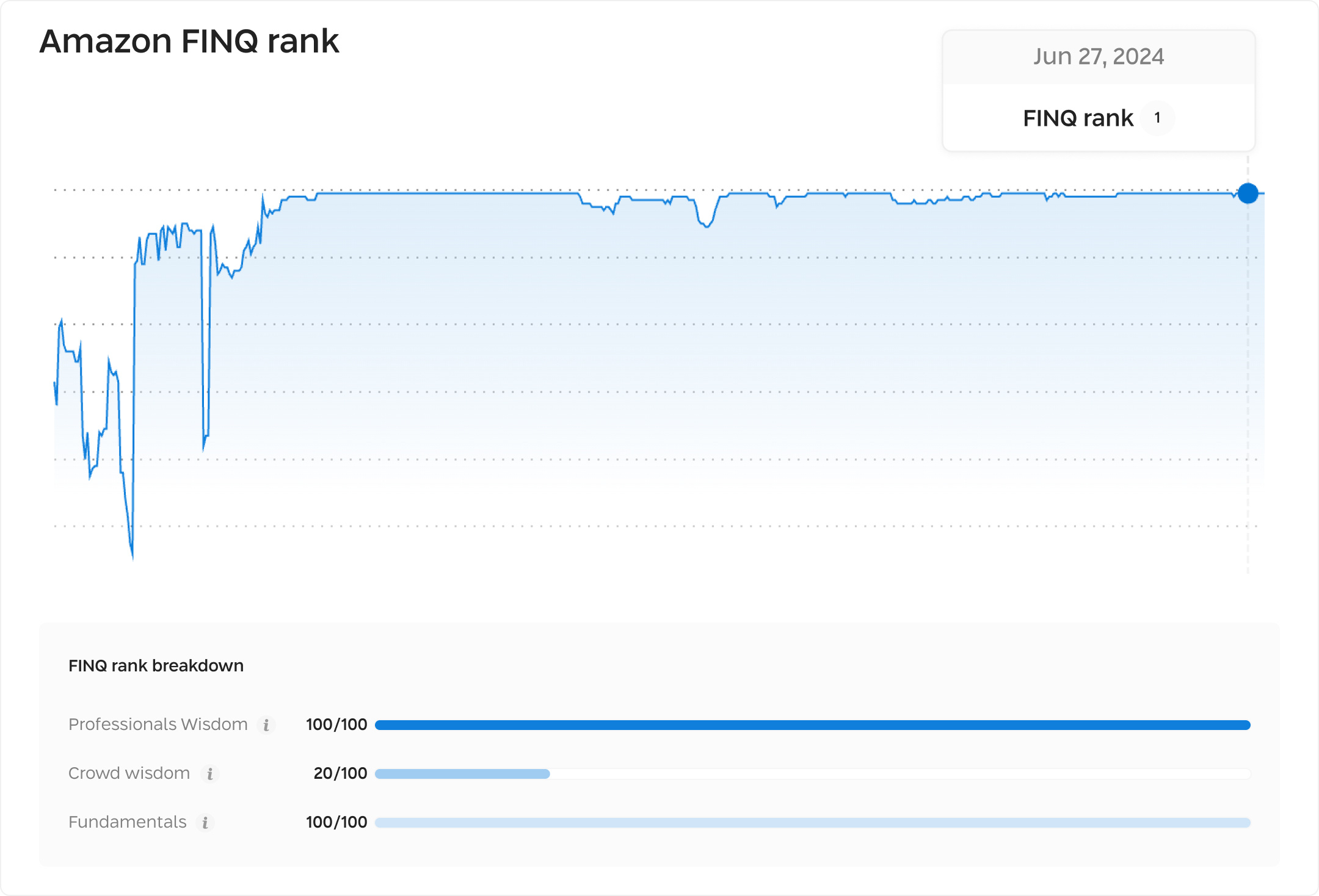

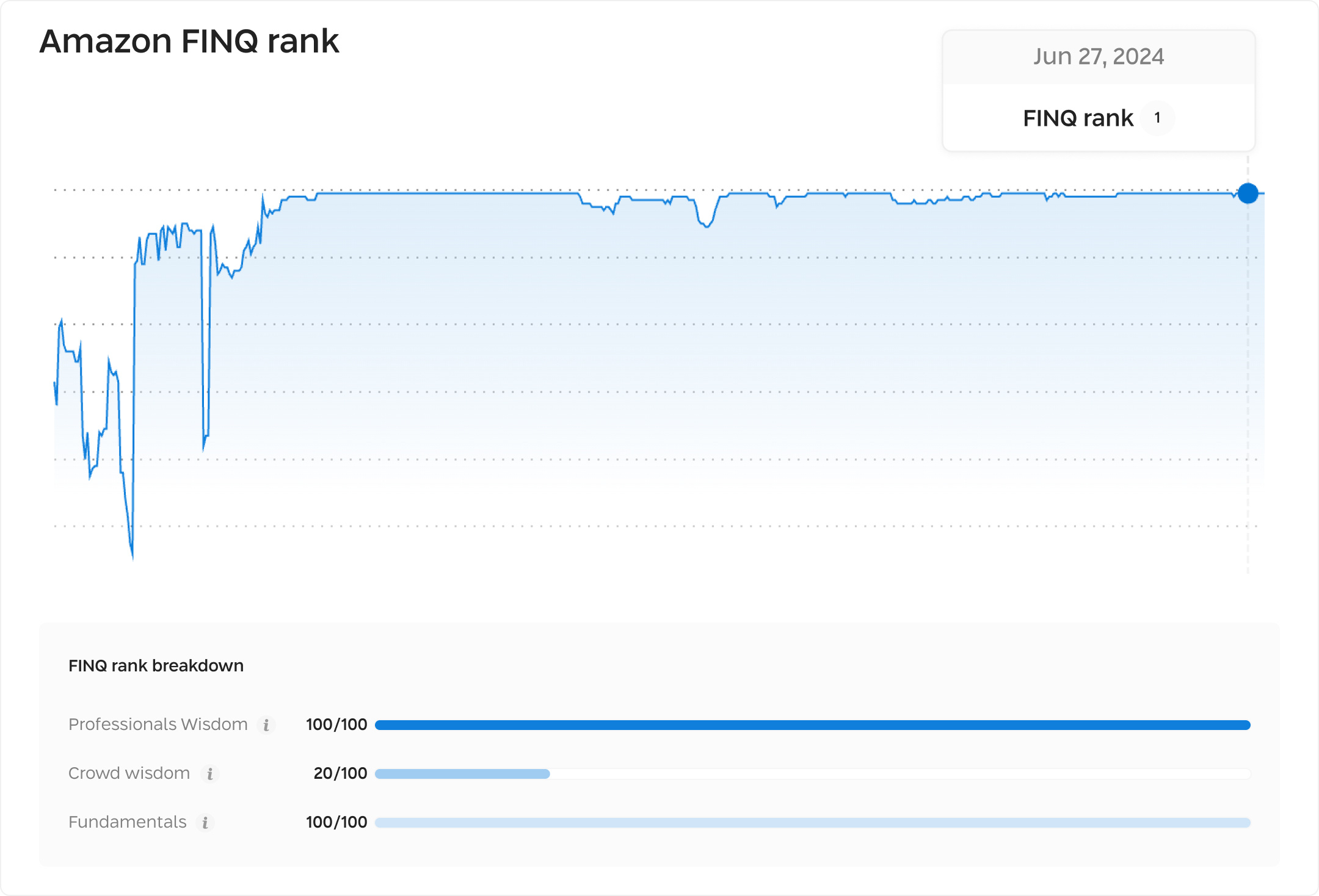

Amazon's FINQ rank

Since January, AMZN has consistently held a top spot in the FINQFIRST rankings, never dipping below the top two. The last time it wasn't in the top 10 was November 17, 2022, when it ranked 16th with scores of 89/100 in Professional Wisdom, 73/100 in Crowd Wisdom, and 0/100 in Fundamentals. Now, AMZN boasts perfect scores of 100/100 in both Professional Wisdom and Fundamentals, though its Crowd Wisdom score stands at 20/100.

2. ServiceNow (NOW)

ServiceNow is a leader in digital workflows, continuously pushing the envelope with AI to improve its services. Based on its Q1 2024 earnings, ServiceNow is riding high. Subscription revenues have soared to $2,523 million, a 25% jump from last year. Overall revenues aren't far behind at $2,603 million. The company's profits are also increasing, exceeding expectations with a net income of $347 million. Over the next year, they're eyeing an impressive $8.45 billion in projected revenues. They've also grown their base of major clients by 15% and plan to ramp up revenue by another 25% and improve cash flow margins. Plus, with exciting new partnerships with the likes of NVIDIA and products on the horizon, ServiceNow is well-positioned to expand rapidly over the next decade.

ServiceNow’s FINQ rank

On October 22, 2023, ServiceNow had a distant 37 ranking, scoring 87 in Professional Wisdom, 66 in Crowd Wisdom, and 33 in Fundamentals. Fast forward to today, and it's a whole different story. ServiceNow has climbed to the number 2 spot, boasting impressive scores of 91 in Professional Wisdom, a perfect 98 in Crowd Wisdom, and another perfect 100 in Fundamentals.

3. Salesforce Inc. (CRM)

Leading AI CRM provider Salesforce started its fiscal 2025 on a high note, with Q1 revenues climbing to $9.13 billion, an 11% increase from last year, and operating cash flow jumping 39% to $6.25 billion. They also gave back $2.6 billion to shareholders through dividends and repurchases. Looking ahead, they expect revenues to reach between $9.20 billion and $9.25 billion next quarter, aiming for $37.7 billion to $38.0 billion by year's end. As the largest player in the CRM market with a 21.8% market share, Salesforce continues to innovate with AI and blockchain and set the stage for ongoing growth.

Salesforce’s FINQ rank

Since late November, CRM has consistently ranked in FINQFIRST's top 10 and climbed into the top 5 by early December. On November 29, 2023, it was outside the top 10, with scores of 93 in Professional Wisdom, 18 in Crowd Wisdom, and 33 in Fundamentals. Today, it's showing significant improvement, with scores of 88 in Professional Wisdom, 92 in Crowd Wisdom, and 100 in Fundamentals.

4. Uber Technologies Inc. (UBER)

Uber began 2024 on a high note with a 20% surge in Gross Bookings to $37.7 billion and an 82% jump in Adjusted EBITDA to $1.4 billion in Q1. Uber also holds a commanding 76% of the U.S. rideshare market. For Q2, Uber anticipates Gross Bookings between $38.75 billion and $40.25 billion, and Adjusted EBITDA between $1.45 billion and $1.53 billion. The company is also implementing a new growth strategy aimed at significantly boosting its mobility and delivery sectors over the next three years. Could Uber reach a trillion-dollar market cap by 2035?

Uber’s FINQ rank

As recently as May 7, 2024, Uber was ranked 11th, scoring 90 in Professional Wisdom, 26 in Crowd Wisdom, and 33 in Fundamentals. Now, it has climbed to the 4th spot with improved scores: 92 in Professional Wisdom, 98 in Crowd Wisdom, and 33 in Fundamentals.

5. NVIDIA Corporation (NVDA)

NVIDIA is on fire, both financially and in the market. In Q1 2024, they posted a jaw-dropping $26.0 billion in quarterly revenue, up 262% from last year. With $49.1B in equity and only $9.7B in debt, they're in great shape. Investors are loving it too – NVIDIA's stock has shot up over 150% this year, pushing their market cap to a massive $3.2 trillion. They're now the world's third most valuable company, and some think their stock could hit $250 by year's end. Looking ahead, NVIDIA's targeting $100 billion in free cash flow over two years and expects its data center revenue to balloon to $280 billion by 2027. With 22% annual growth forecasts and their strong AI position, it's an impressive run, and NVIDIA shows no signs of slowing down.

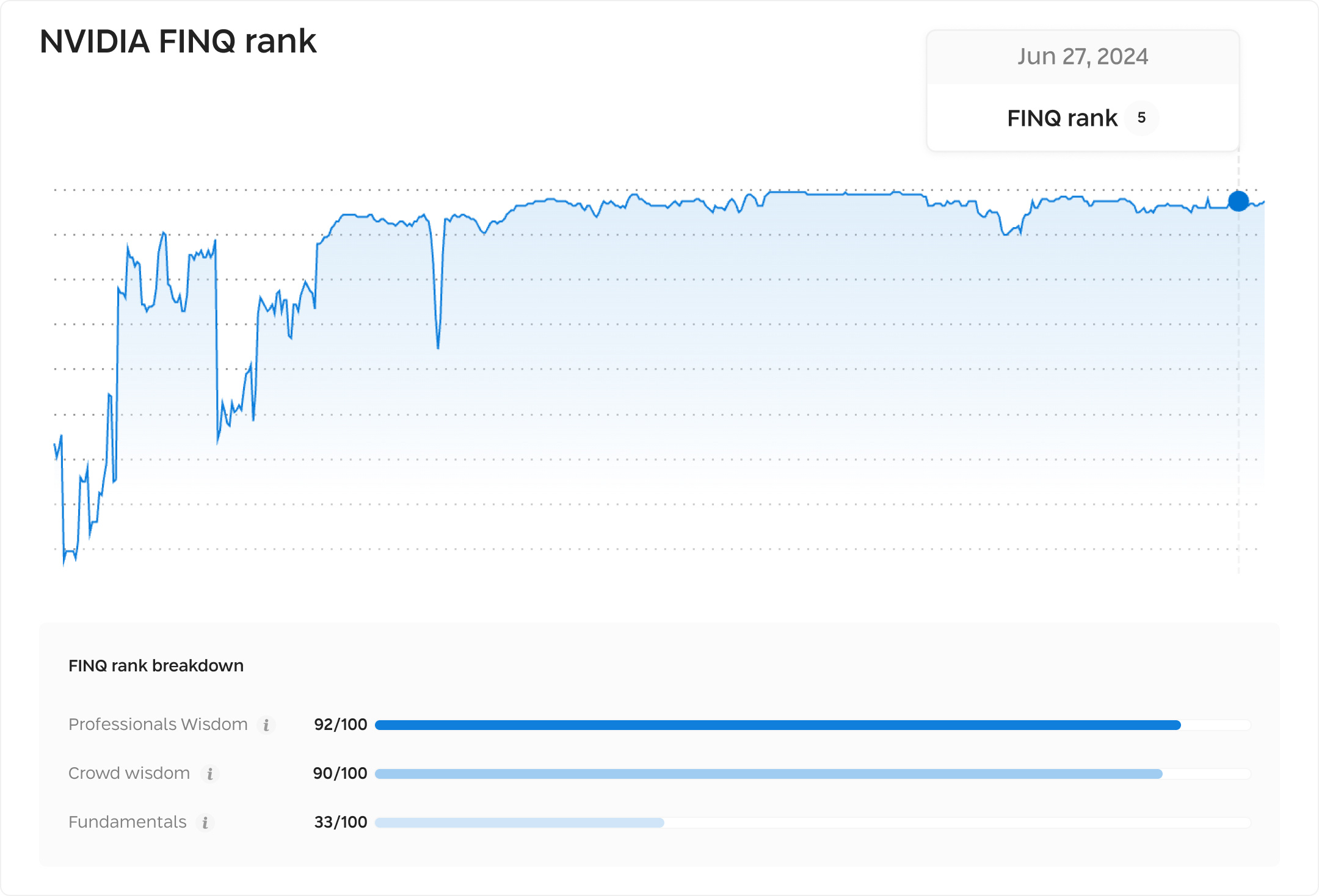

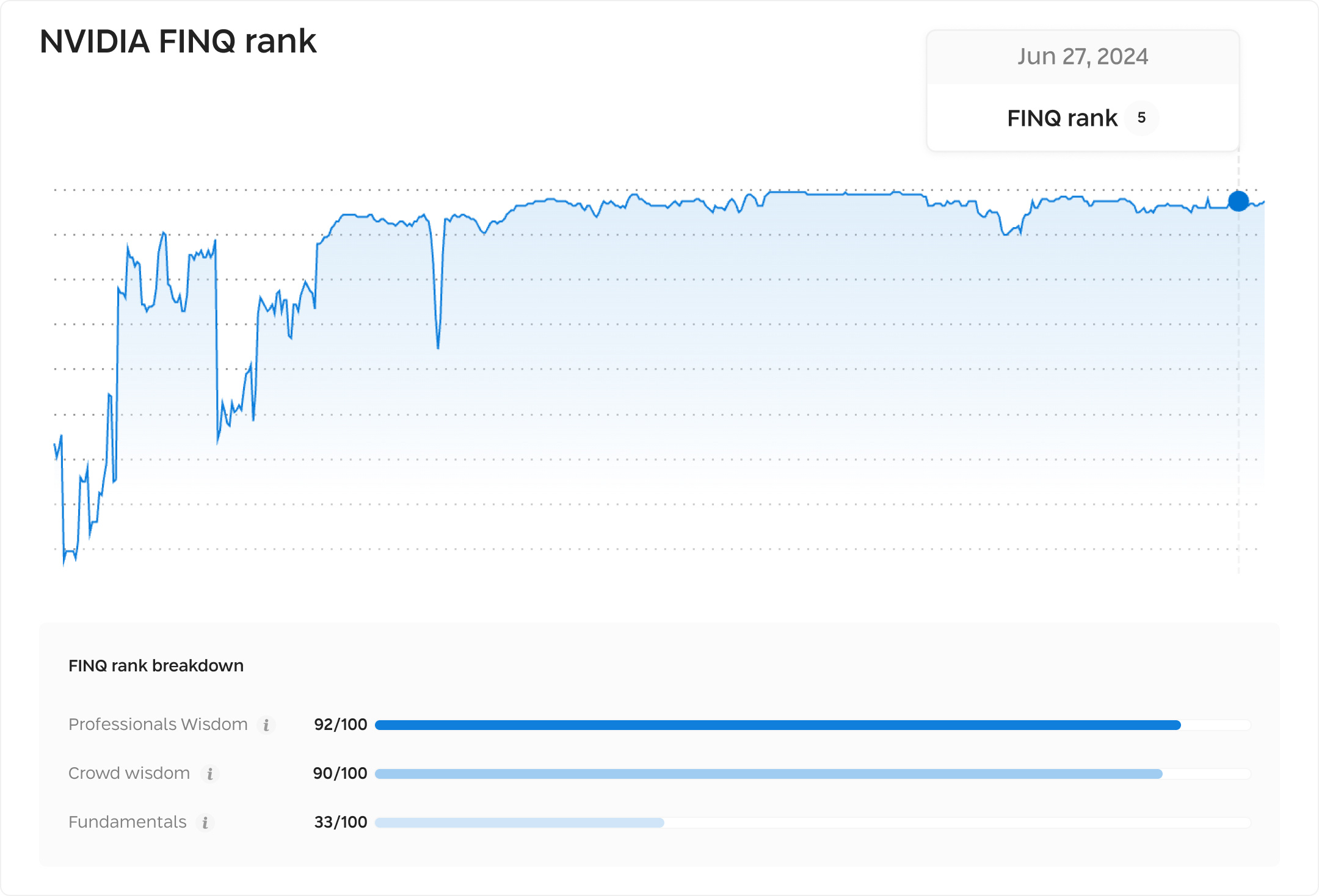

NVIDIA Corporation (NVDA)

NVDA held the 11th spot on February 21, 2024, with scores of 93/100 in Professional Wisdom, 66/100 in Crowd Wisdom, and 33/100 in Fundamentals. It now scores 88/100 in Professional Wisdom, 90/100 in Crowd Wisdom, and 33/100 in Fundamentals.

Honorable mentions

We couldn’t conclude this piece without examining the five stocks rounding out our ten top stocks for Q1 2024 and how their FINQ scores have changed.

6. Microsoft Corporation (MSFT)

As of January 29, 2024, Microsoft (MSFT) had a 23 ranking, scoring 92 in Professional Wisdom, 10 in Crowd Wisdom, and 33 in Fundamentals. Today, the company has improved, with its Professional Wisdom score rising to 94 and its Crowd Wisdom score increasing to 50, while its Fundamentals score remains steady at 33.

7. Alphabet Inc. (GOOGL)

On January 25, 2024, Alphabet had a 76 ranking, scoring 86/100 in Professional Wisdom, 52/100 in Crowd Wisdom, and 0/100 in Fundamentals. Today, it boasts a score of 93/100 in Professional Wisdom, 60/100 in Crowd Wisdom, and 33/100 in Fundamentals.

8. Global Payments Inc. (GPN)

On May 23, 2024, GPN ranked 22nd with 76/100 in Professional Wisdom, 90/100 in Crowd Wisdom, and 100/100 in Fundamentals. Today, it scores 87/100 in Professional Wisdom and 56/100 in Crowd Wisdom and retains a 100/100 in Fundamentals.

9. Palo Alto Networks (PANW)

As recently as May 19, 2024, PANW was ranked 26th with scores of 85/100 in Professional Wisdom, 10/100 in Crowd Wisdom, and 33/100 in Fundamentals. It has improved to 92/100 in Professional Wisdom and 66/100 in Crowd Wisdom and maintains a 33/100 in Fundamentals.

10. PayPal Holdings Inc (PYPL)

PYPL was previously 84th on May 17th, 2024, scoring 69/100 in Professional Wisdom, 20/100 in Crowd Wisdom, and 100/100 in Fundamentals. It currently holds scores of 86/100 in Professional Wisdom, 20/100 in Crowd Wisdom, and 100/100 in Fundamentals.

FINQ: a smarter platform for the new era

Imagine spotting winning stocks consistently and regularly—FINQ's track record speaks for itself, with gains that outpace the S&P 500 and redefine what smart investing looks like. FINQ makes sense of the market’s chaos with its cutting-edge AI and algorithms not only to comb through mountains of data but to understand it and make it more accessible. FINQ transforms complex market dynamics into clear, actionable insights, empowering you, whether you’re starting or have been in the game for years.

Remember, staying on top of your investment game means more than just following trends; it involves a strategic, well-informed approach. Whether aiming to grow your savings or planning for a big financial goal, incorporating FINQ into your strategy offers a clearer view of the market, so you're not just reacting to changes but anticipating them. Embrace the power of informed investing with FINQ, and watch your financial goals come to life.